- Profit & Income tax Effects

- Strategies

Caroline Feeney ‘s the Elder Managing Editor from the HomeLight in which she oversees the seller Funding Cardio, a blogs presenting numerous inside-depth articles one to tackle every step of the home marketing procedure. In the past she supported because an editor for real property business book Inman Information and co-composed a book on the a property leaders. The newest Midwest indigenous keeps a great master’s about Missouri School from Journalism and you will is actually earlier a bona fide home contributor for Forbes.

At HomeLight, all of our attention was a scene where all a home purchase are simple, certain, and you will fulfilling. Hence, i render rigorous editorial stability inside each of our listings.

DISCLAIMER: This post is designed for instructional objectives just which will be maybe not intended to be construed as the monetary, tax, or legal services. HomeLight always prompts one reach out to a mentor off your situation.

Actually, it occurs for hours. Very mortgages come with 15 otherwise 31 year terms and conditions, since the average go out someone stayed in their homes recently , according to data from the National Relationship away from Real estate professionals.

What’s Your home Worthy of?

Consult an easy house well worth guess to help you to own a good ballpark estimate of how much cash equity you’ve got ahead of selling property that have home financing.

Therefore luckily for us, you’re not stuck for the a home if you don’t pay all of the history dollars. Here are the brief factors to know on exactly how to offer property which have a mortgage:

- You will employ the brand new arises from the new revenue in your home to help you pay back your home loan harmony. Your bank gets the payout during closing.

- Just after rewarding the borrowed funds loans and you will within the fees on the selling a home such as for instance profits and you may fees, you will (develop!) possess some winnings when deciding to take family.

- In the event the matter gotten throughout the deals falls lacking their a great mortgage balance and you may selling can cost you, you will need to safeguards the real difference with loans besides men and women on marketing.

- These days in which possessions viewpoints have seen high develops, it isn’t prominent to possess suppliers so you’re able to are obligated to pay over their property deserves, a posture that’s called are under water.

- A mortgage is more planning become under water in the event that a provider falls behind with the mortgage repayments, offers in advance of they have gained far guarantee, otherwise deal while in the market downturn.

step 1. Check your domestic value

Start with delivering a sense of exactly how much you reside worth. Getting an effective ballpark contour, you need to use an online domestic really worth estimator.

Our house Well worth Estimator sets housing industry analysis out-of numerous respected supplies that have information regarding your residence which you really display.

Keep in mind that our guess unit isnt a promise out of exacltly what the home will sell getting. Towards open market, a purchaser can be prepared to pay mostly than just exacltly what the imagine reveals.

Your own realtor provides you with a very precise count having fun with a relative sector investigation (CMA) one to analyzes the worth of your residence according to equivalent sales, a hack that you’re going to use to rate your home whenever your day will come.

A realtor can eliminate comparable sales using their regional Multiple listing service, providing them with better wisdom into the city. A realtor will also more than likely demand doing good walkthrough out of your house to inform their assessment.

dos. Contact your financial

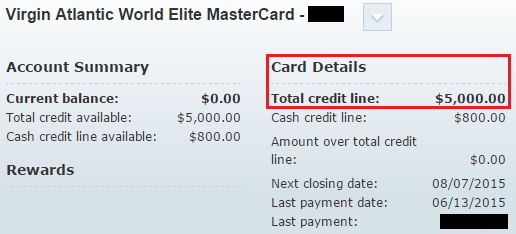

2nd, we should find out how far you continue to owe with the your own home loan. Their financial is required to supply https://paydayloanflorida.net/pioneer/ the overall count required to satisfy the financial financial obligation since a selected big date, with respect to the Consumer Economic Protection Bureau, a statistic known as the benefits count.

Leave a Reply