One thing to note is that just like in the accounting equation, total assets equals total liabilities and equity. If you are preparing a balance sheet for one of your accounting homework problems and it doesn’t balance, something was input incorrectly. You’ll have to go back through the trial balance and T-accounts to find the error. Maintaining your business’s financial health is a key component of long-term success.

Could Your Business Benefit from Asset Tagging? Here’s How!

Financial ratio analysis uses formulas to gain insight into a company and its operations. For a balance sheet, using financial ratios (like the debt-to-equity (D/E) ratio) can provide a good sense of the company’s financial condition, along with its operational efficiency. It is important to note that some ratios will need information from more than one financial statement, such as from the balance sheet and the income statement.

How does a manufacturing company report taxes?

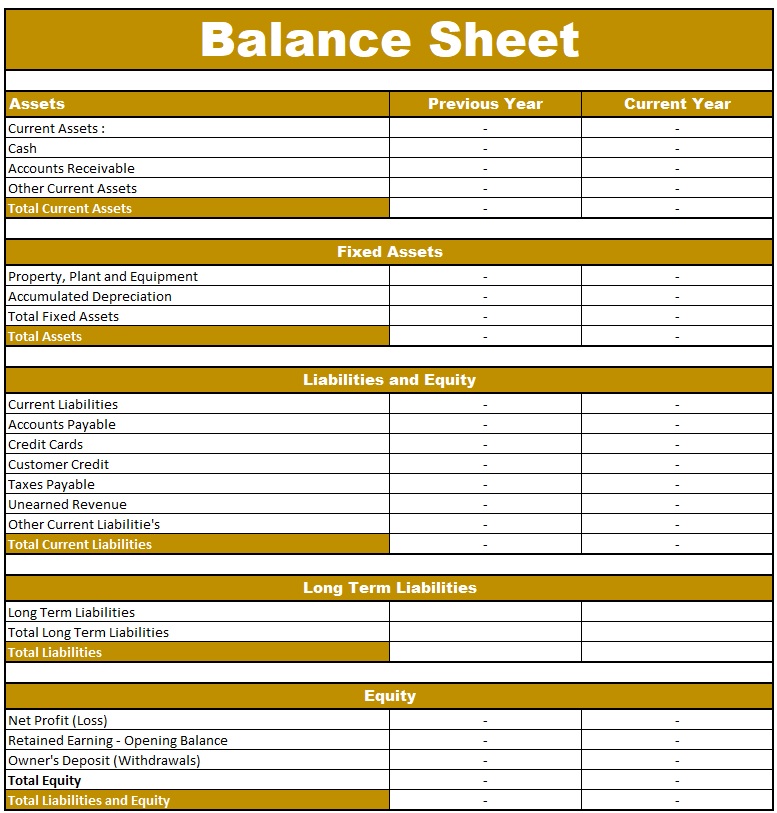

A balance sheet is a financial statement that lists a company’s assets, liabilities, and equity. The purpose of a balance sheet is to provide a summary of the entity’s financial position at a specific point in time. As such, the balance sheet may also be referred to as the statement of financial position. The operating cash flow ratio rearrange rows and columns in numbers on mac determines how many times a company can pay off its current liabilities with the current generated cash. The more times it can, the better financial position it is in; however, too high a number may mean it is not using its assets effectively. A balance sheet explains the financial position of a company at a specific point in time.

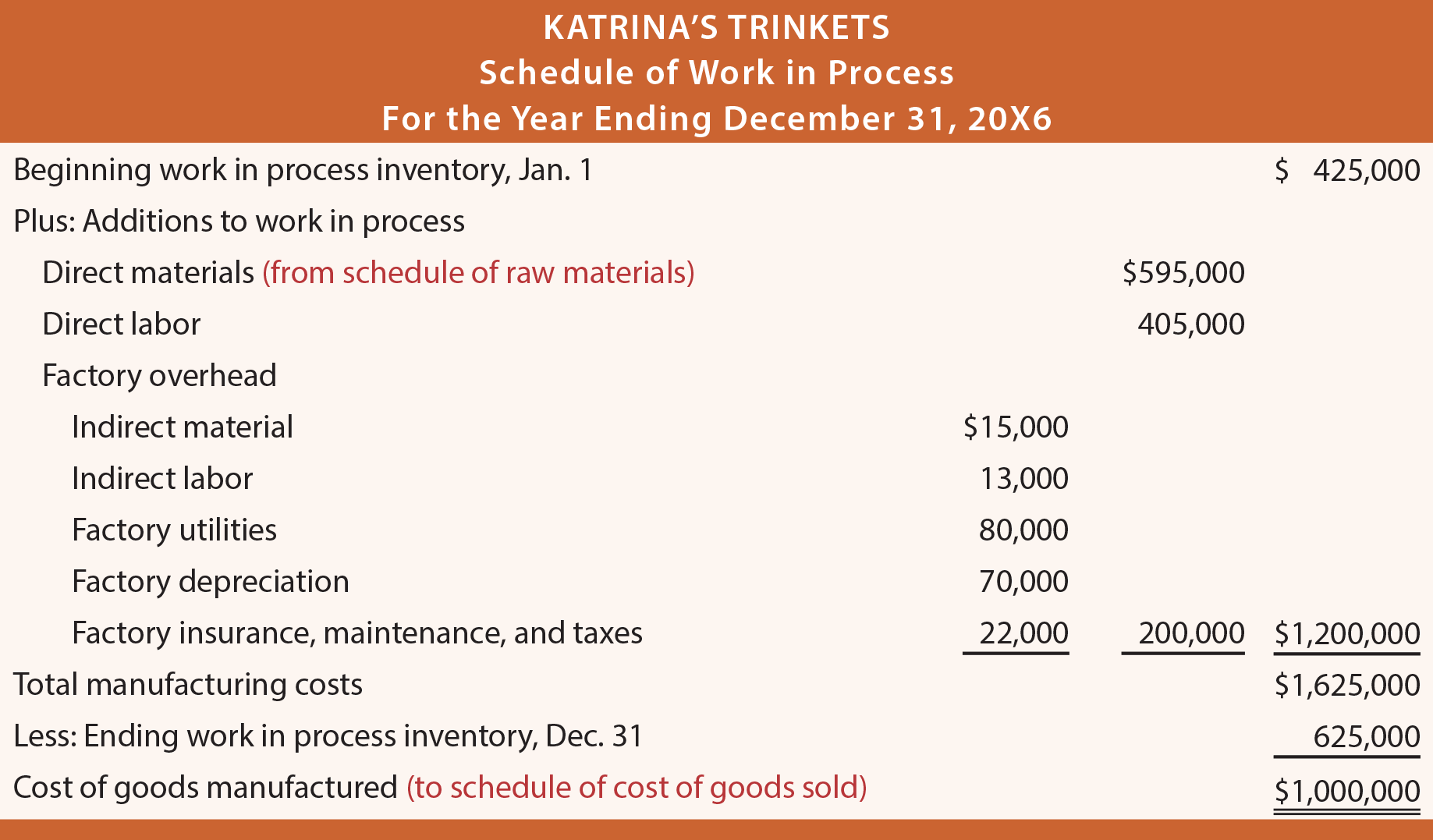

Allocate Factory Overhead Appropriately

External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to. Assume that finished goods are transferred from the factory to the warehouse at production cost plus a 10% manufacturing profit. Preparing a manufacturing account shows the cost of materials consumed, productive wages, direct and indirect expenses of production, and the cost of finished goods produced.

Is there any other context you can provide?

By analyzing your liquidity position (i.e. cash and receivables), you’ll see whether you can afford upcoming expenses or handle a market shock. Additionally, you can analyze historical trends in your assets and liabilities to ensure your business is running properly, or to identify problem areas quickly. If the numbers don’t look good, it can prompt an internal shift in how you conduct the business.

- Companies often sell products or services to customers on credit; these obligations are held in the current assets account until they are paid off by the clients.

- Since manufacturing companies typically own a number of long-term assets, accumulated depreciation is often significant.

- The complexity of tracking raw materials, work-in-progress, and finished goods often results in significant valuation errors.

- In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report.

How does a manufacturing company differ from a merchandising company in the reporting of income statements?

We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. We offer self-paced programs (with weekly deadlines) on the HBS Online course platform.

In Chapter 2, we look at an alternative approach to recording manufacturing overhead called normal costing. Profitability ratios are financial metrics used to assess the profitability of a company. Common profitability ratios include gross profit, operating profit, net profit, EBITDA, return on assets, and return on equity. A manufacturing company incurs expenses while producing a product as well as indirect costs needed to operate the business. From an investor’s standpoint, it is more desirable to see a majority of costs directly tied to production as opposed to other expenses, including supervisor salaries or building rent. These financial ratios are equally useful to an investor wishing to gain a deeper understanding of a manufacturing company.

The makeup of a retailer’s inventory typically consists of goods purchased from manufacturers and wholesalers. Accounts receivables (AR) consist of the short-term obligations owed to the company by its clients. Companies often sell products or services to customers on credit; these obligations are held in the current assets account until they are paid off by the clients. Investors, creditors, and internal management use the balance sheet to evaluate how the company is growing, financing its operations, and distributing to its owners. It will also show the if the company is funding its operations with profits or debt. Now that the balance sheet is prepared and the beginning and ending cash balances are calculated, the statement of cash flows can be prepared.

Larger businesses will often create monthly balance sheets, while small businesses or startups typically create them quarterly. An income statement, also called a profit and loss (P&L) statement, lists out a company’s revenue streams (such as sales) and expenses (payroll, operating expenses, etc.) over a given period of time. C This is actual manufacturing overhead for the period and includes indirect materials, indirect labor, factory rent, factory utilities, and other factory-related expenses for the month. Later, we will look at an alternative approach to recording manufacturing overhead called normal costing. Moreover, leveraging advanced accounting systems can significantly streamline the process of financial reporting, making it easier for stakeholders to access accurate and timely data.

List the current liabilities that are due within a year of the balance sheet date. These include accounts payable, short-term notes payable, and accrued liabilities. The liability section of the balance sheet demonstrates what money you currently owe to others, this includes recurring expenses and various forms of debt. They are either long-term liabilities (also called non-current liabilities) or current liabilities.

Leave a Reply